Compare cheap van insurance quotes

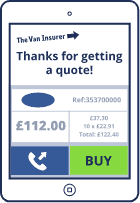

51% of customers paid less than £563 between 1 January 2023 and 31 March 2023 †

Compare quotes from up to 44 brokers

Insure your van with one of the providers on our panel.

How comparison works

You tell us details about yourself and what you're looking to insure

We provide instant quotes from a panel of top UK insurers

You choose the policy you want, buy it, and job done!

We’ve been helping customers save money on their van insurance for years!

Shopping around and comparing provider quotes can help you find the cheapest coverage for your needs. Automatically renewing your policy with your current provider may mean you lose out on cheaper deals available in the wider market.

When you use The Van Insurer’s quotation services; we’ll compare multiple providers to help find the cheapest available coverage for you.

Building a no-claims discount, by remaining claim-free over a consecutively insured number of years helps demonstrate to potential insurers that you have a history of safe driving and are a lower risk to insure.

Properly installing approved security devices such as alarms, immobilisers, or trackers can reduce the risk of theft or damage and may help lower your premium.

It may sound simple, but the less time you spend on the roads, the less likely you are to be involved in an accident. Consider putting in place a mileage limit with your insurer but be sure to remember what it is and not to stray over it.

Increasing the voluntary excess that you’re willing to pay upfront in the event of a claim can lower van insurance quotations, but be sure only to choose an amount you can afford and remember that in addition to a voluntary excess, there may be a compulsory excess too.

If you overestimate your van’s value during the process of obtaining a quote for your insurance, you’re likely to get higher quotations. Also, avoid paying for unnecessary add-ons to help keep your insurance costs low.

Paying for your van insurance upfront instead of through monthly instalments can assist you in lowering your insurance costs. Insurers often charge interest or fees when customers pay in instalments.

Insurers consider modified vans riskier to insure because they may have higher performance capabilities, be more attractive to thieves, or have alterations that could increase the likelihood of an accident.

Modified parts or customisations may be more expensive to repair or replace in the event of an accident as well, so if you're modifying your van, be sure to factor in potentially higher insurance premiums as a result.

Smaller vans are generally less expensive to repair or replace. They tend to have smaller engines, meaning they’re less powerful and less likely to be involved in high-speed accidents.

Installing a telematics device (also known as a black box) that monitors your driving behaviour can help you earn discounts based on safe driving habits.

More drivers on your policy can increase the likelihood of an accident or claim.

Insurers consider each driver's age, driving experience, and history when calculating premiums. They may charge higher premiums for policies with more drivers, especially if those drivers are inexperienced or have a history of accidents or claims.

Choosing a cheap deal with low levels of coverage could leave you exposed in the event of a claim. Don’t just opt for the lowest prices: compare quotes with The Van Insurer to help find the most suitable coverage for your vehicle and always make sure you read the policy documents so you understand what is and isn’t covered by the insurer.

How do I compare van insurance with The Van Insurer?

Personal Details

First, we’ll need to know a bit about you!

This includes your name, address and occupation, as well as your type of driving licence and when you got it.

Your driving history

Then we’ll need to know more about your driving history:

❖ Details of any claims or convictions

❖ Your annual mileage and intended van usage

❖ Details of any No Claims Bonus you have earned

Vehicle Details

Lastly, we’ll need some details about the van you’re planning to insure, including things like:

❖ The make, model and engine cc of your van

❖ Its year of manufacture and its current value

❖ When you bought your van (if you already own it)

This may help cover any legal expenses that arise from an accident or other incidents involving your van.

This assists you if your van breaks down while you're on the road and can cover towing and repairs.

Employers’ liability insurance can cover the cost of compensating employees who become ill or are injured during the work they do for you.

This add-on is designed to provide you with a replacement vehicle to drive while yours is being repaired.

If a member of the public decides to sue you for damages or injuries, public liability insurance helps provide cover for your legal costs as well as any compensation you may be ordered to pay.

Tool insurance can help cover the replacement cost if your tools are stolen from your van or damaged.

Hire vehicle cover is a type of insurance policy that provides insurance coverage for rental vehicles.

Personal injury cover helps provide financial protection for the driver and possibly passengers in a van in the event of an accident that results in injury or death.

This can help cover the cost of repairing or replacing any business tools, equipment, or other items stolen or damaged while in your van.

This can help cover the cost of repairing or replacing your personal items if they are lost, stolen, or damaged.

It can include items such as jewellery, watches, mobile phones, cameras, and laptops, among others. However, the specific items covered depend on your chosen policy and coverage limits.

This covers repair costs if you accidentally fill up your vehicle with the wrong fuel type: petrol instead of diesel and vice versa.

This protects your no-claims discount (NCD) bonus even if you have to make a claim. There may be an upper limit to the number of claims you can make however.

FAQs

Yes, to drive on public highways in the UK, you must have the minimum third-party insurance in place.

However, if you’ve already registered your van as being kept off public roads with a Statutory Off-Road Notification (SORN), you do not need to purchase coverage.

There are more than 40 insurers on our panel including such names as Admiral, Devitt, Swinton and many more.

Possibly yes: this is called multi-van insurance and allows you to insure multiple vans under one policy. Speak to your insurer for further details.

Additional drivers can usually be added to existing insurance policies; speak to your insurer about this. You should give your insurer the personal details of each driver you would like to add, including their driving history and experience, age, and any history of claims or accidents. You may need to pay an additional premium.

If your van is being repaired, you may be able to get a courtesy car or van. However, this depends on your level of coverage. If it’s not included in your policy as standard you may be able to include it as an add-on for an extra fee.

The Van Insurer is a provider of insurance price comparison services and we do not sell insurance ourselves. We can provide you with quotations for private and commercial van insurance from the panel of regulated insurance companies we work with. Whether you’re looking to insure your HGV, private van or multiple vans under one policy we should be able to help.

This depends on the specific policy and insurer.

In Europe?

All UK vehicle insurance provides the minimum third-party cover to drive in:

The EU (including Ireland)

● Andorra

● Bosnia and Herzegovina

● Iceland

● Liechtenstein

● Norway

● Serbia

● Switzerland

If EU protection is not standard in your policy, you may want to pay extra for foreign use coverage.

For business?

If your vehicle is covered by a commercial, third-party coverage policy, your UK insurance should automatically cover you on a third-party basis while travelling through the EU.

However, you may want to purchase add-ons like van content cover to protect any goods, materials or tools inside your van.

Some van insurance providers offer telematics insurance (black box coverage).

If you are involved in an accident with your van that wasn’t your fault, legal cover can help cover the cost of legal expenses associated with pursuing legal action.

Age restrictions for van insurance can vary between insurers. Some may not insure drivers under 21, whereas others might have a minimum age of 25. Due to a lack of driving experience, young drivers may often be charged more for their insurance.

Some providers may allow you to use your NCD on any vehicle, whether you’re insuring a motorbike, car or van. However, they may restrict the discount to one policy.

Whether the contents of your van are covered under your insurance are likely to depend on your specific insurer and type of policy taken out. However, you may be able to purchase add-ons, like van contents cover and personal belongings cover, for extra protection.

If you recently purchased a second-hand van and want to check if it's insured, you can use the free ask MID (Motor Insurance Database) service by entering your vehicle's registration plate into the yellow box.

If your van insurance policy includes a ‘drive other vehicles’ clause, you could be insured to drive other vehicles on a third-party basis only. If in doubt, speak to your insurer before driving someone else’s van.

If the modifications significantly alter the van's performance, handling, or value, your insurer may consider it a material change to the policy.

Material changes can affect the level of risk the insurer is covering, and therefore the terms and conditions of the policy may need to be adjusted. Speak to your insurer before making any alterations to your van to ensure continuity of cover.

A voluntary excess is the fixed amount you agree to pay towards the cost of any insurance claim you make. This amount is agreed upon when you take out an insurance policy and is typically stated in your policy documents.

For example, if you have a van insurance policy with a voluntary excess of £250 and you make a claim for £1,000, you’ll be required to pay the first £250 of the claim.

Please be aware that some policies might also include a compulsory excess, which must be paid by you in the event of claim and this will be in addition to any voluntary excess that you have agreed to.

All vans are categorised into one of fifty groups that go from 1 to 20 (for vans made before 2016) and from 21 to 50 (for vans made after 2016).

To find out which group your van belongs to you can use the Vehicle Search Tool from Thatcham.

Check the terms and conditions of your car insurance policy. Some comprehensive car insurance policies may offer third-party cover for your van, but you should always check with your insurer before assuming this applies to your coverage.

No, you can take out an insurance policy on a van you do not own. However, you must have a valid insurable interest in the van, which means you must have some financial stake in the vehicle.

Insurance Premium Tax (IPT) is a tax added to the cost of most insurance policies.

The standard rate is charged as a percentage of the total premium paid for the policy and is collected by insurers on behalf of the UK government. The standard rate is currently set at 12%. [3]

Uninsured losses are expenses or damages that are not covered by your insurance policy. Depending on the coverage you purchase, this could include vehicle repairs, fire damage or the loss of personal property.